tax saving strategies for high income earners canada

The highest rate of 33 per cent. Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds a set amount.

Corporate Income Taxation And Inequality Review And Discussion Of Issues Raised In The Triumph Of Injustice How The Rich Dodge Taxes And How To Make Them Pay 2019 Faccio Review

Contact a Fidelity Advisor.

. How to Reduce Taxable Income. Max Out Your Retirement Account. Income splitting and trusts.

Generally unknown to high income earners is the existence of many smart and legal tax-saving strategies in Canada. For 2021 the IRS Solo 401k contribution limit is 58000 before eligibility for catch-up contributions. Registered Education Savings Plan RESP If you need to pay for your childrens post-secondary.

Lets take a look. The investment income and capital gains generated in the plan are not subject to tax until you make a withdrawal in the future. Income Splitting and Trusts.

For high income earners and high-net-worth families taxes can pose a significant impediment to preserving and growing wealth particularly in cases where income or wealth is. Qualified Charitable Distributions QCD 4. Here are some of our favorite income tax reduction strategies for high earners.

A Solo 401k for your business delivers major opportunities for huge tax deductions every year. This has to generally be done within annual gift exclusions or loans. Here are 50 tax strategies that can be employed to reduce taxes for high income earners.

For the nations highest-income earners those making more than 220000 annually the amount. In 2022 a higher standard deduction of 12950 for individuals and 25900 for joint filers makes it harder for high-income earners to. In doing this the high income spouse utilizes.

Tax deductions are expenses that can be deducted from your taxable. Tax planning strategies for high-income earners. Here are some of the most effective tax minimization strategies for high-income individuals.

Discover several strategies that make for a tax-smart wealth plan. Wealthy Canadians use these accounts too though Jamie Golombek managing director of tax. If extra study or developing your skills are of interest to you then you can pay for self-education professional development or training and claim this on your tax.

While the money you contribute to your TFSA will be post-tax income any interest dividends or capital gains earned in it are tax-free for life and you wont have to pay taxes on the withdrawals. These retirement accounts use pre-tax money so you can deduct your contributions from your taxable income. Tax-free savings accounts TFSAs are another option.

This is one of the most important tax strategies for you as a high-income earner. Here are 50 tax strategies that can be employed to reduce taxes for high income earners. High-income earners make 170050 per year in gross income or 340100 if married or filing jointly.

If properly structured family trusts or partnerships can help you move your investment earnings to family members with lower marginal tax rates. New tax legislation made small reductions to income tax rates for many individual tax brackets. We will begin by looking at the tax laws applicable to high-income earners.

Top Tax-Saving Strategies for High-Income Earners in Canada. Ad Take Advantage of Tax-Smart Investment Tips for Your Portfolio. When personal income exceeds 200000 in Canada the earner has to pay taxes at a rate of 50 or higher depending on the province of residence.

You may also want to consider contributing to a spousal RRSP for your low income spouse to equalize future retirement income. Like most other places if you live or earn income in Canada you will have to pay income tax. Making a gift to an adult family member.

50 Best Ways to Reduce Taxes for High Income Earners. Using the benefits of a registered education savings plan RESP or registered disability savings plan RDSP Investing child tax benefit money in the childs name. Here are 50 tax strategies that can be.

You could also hire an executive coach. That means that if you earn more than 170050 in. This small business tax strategy lets you take full advantage of the marginal tax rate disparities.

The math is simple. Thats right you dont need to move your money offshore. Lets start with an overview of tax rules for high-income earners.

Canadian tax law allows for several ways to reduce your taxes owed if you know the current rules and. For the sake of this post we consider anybody in the top three tax brackets as a high-income earner. Loaning funds at the prescribed rate of interest to a spouse 1.

Self-Education Training or Executive Coaching. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. 6 Tax Strategies for High Net Worth Individuals.

Having the higher income earner pay family expenses. The change applies to high-income individuals who make additional contributions to a retirement program during a tax year. Registered Retirement Savings Plans RRSPs As a high income earner in Canada you.

Specifically contribute to a traditional 401 k or IRA. A Solo 401k can be the single most valuable strategy among all the tax saving strategies for high income earners. Overview of Tax Rules for High-Income Earners.

Ad Helping Businesses Navigate Various International Tax Issues. But the tax changes are only temporary and increased the standard deduction for individual and joint filers alike.

Pdf The Canadian Income Taxation Statistical Analysis And Parametric Estimates

How Do Taxes Affect Income Inequality Tax Policy Center

The Canadian Income Taxation Statistical Analysis And Parametric Estimates Kurnaz Canadian Journal Of Economics Revue Canadienne D 233 Conomique Wiley Online Library

The Canadian Income Taxation Statistical Analysis And Parametric Estimates Kurnaz Canadian Journal Of Economics Revue Canadienne D 233 Conomique Wiley Online Library

Effective Tax Functions Individuals 2015 Download Scientific Diagram

Why It Matters In Paying Taxes Doing Business World Bank Group

Personal Income Tax Progressivity Trends And Implications In Imf Working Papers Volume 2018 Issue 246 2018

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Income Tax In Germany For Foreigners Academics Com

Personal Income Tax Brackets Ontario 2021 Md Tax

The Canadian Income Taxation Statistical Analysis And Parametric Estimates Kurnaz Canadian Journal Of Economics Revue Canadienne D 233 Conomique Wiley Online Library

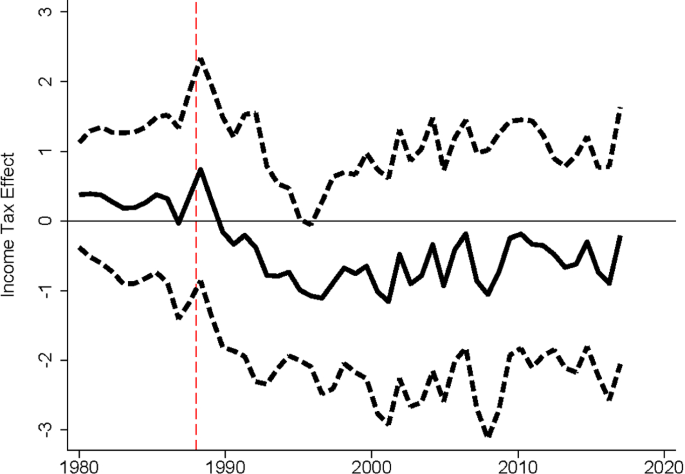

State Income Taxes And Team Performance Springerlink

The Canadian Income Taxation Statistical Analysis And Parametric Estimates Kurnaz Canadian Journal Of Economics Revue Canadienne D 233 Conomique Wiley Online Library

Tax Minimisation Strategies For High Income Earners

High Income Earners Need Specialized Advice Investment Executive

The Canadian Income Taxation Statistical Analysis And Parametric Estimates Kurnaz Canadian Journal Of Economics Revue Canadienne D 233 Conomique Wiley Online Library

Chapter 2 Modernizing The Tax Policy Regime In Modernizing China